Proper Timeframe Alignment

- Home

- Proper Timeframe Alignment

The Importance of Timeframe Alignment

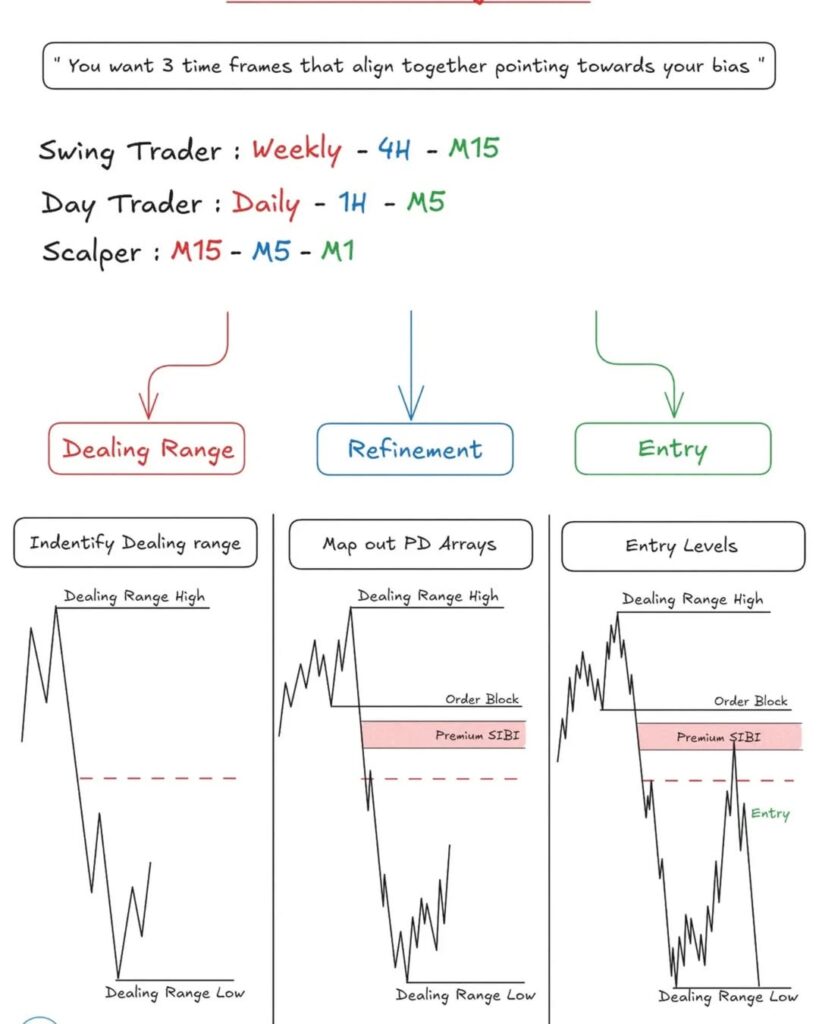

Aligning multiple timeframes is a critical step in trading. It ensures that the chosen setup reflects the overall market trend and minimizes conflicting signals. This strategy uses three aligned timeframes—higher, middle, and lower—to analyze market structure, refine points of interest, and pinpoint precise entry levels.

Framework:

- Swing Trader:

- Timeframes: Weekly – 4H – M15

- Objective: Capture larger moves over days or weeks using higher timeframe trends and lower timeframe refinement for precise entries.

- Day Trader:

- Timeframes: Daily – 1H – M5

- Objective: Focus on intraday trends, leveraging the 1-hour chart for structure and the 5-minute chart for pinpoint entries.

- Scalper:

- Timeframes: M15 – M5 – M1

- Objective: Seek quick trades with tight stops by leveraging the lowest timeframes.

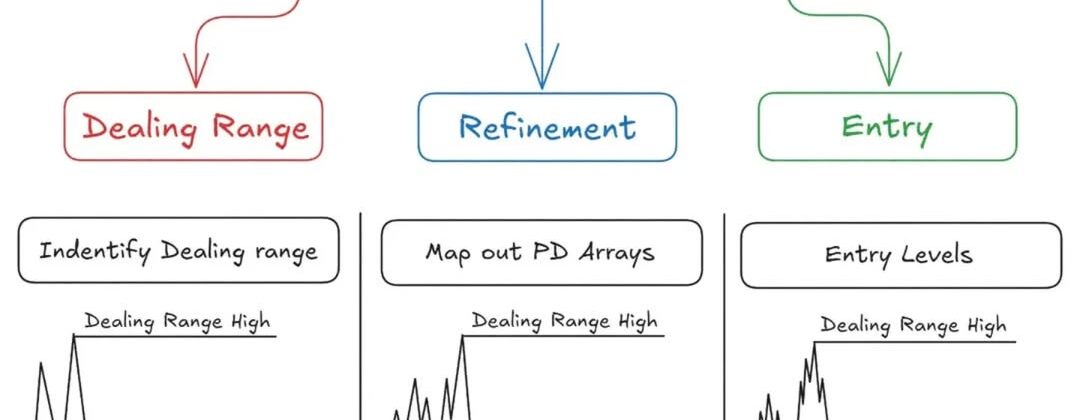

Steps for Trade Setup:

- Dealing Range Identification:

- Use the higher timeframe to define the Dealing Range High and Dealing Range Low.

- This range provides the framework for price movement and areas of interest.

- Refinement of Points of Interest (POI):

- On the middle timeframe, map out Premium PD Arrays like Order Blocks or areas of liquidity (e.g., Premium SIBI – Sell-Side Imbalance, Buy-Side Inefficiency).

- Focus on price reactions near these zones.

- Entry Levels:

- Use the lowest timeframe to confirm entries with confluence, such as rejections, candlestick patterns, or liquidity sweeps.

- Ensure risk-reward aligns with your trading plan.

Trade Idea Example:

- Scenario: A swing trader identifies a bearish dealing range on the Weekly chart.

- 4H Chart: The price reaches a Premium Order Block and exhibits signs of rejection.

- M15 Chart: A clear liquidity sweep occurs near the Order Block, providing an entry with confirmation.

- Trade Execution: Enter short with a stop above the Order Block and a target near the Dealing Range Low.

By aligning timeframes, you enhance the probability of success and improve clarity in execution.

Leave A Comment