Mitigation

- Home

- Mitigation

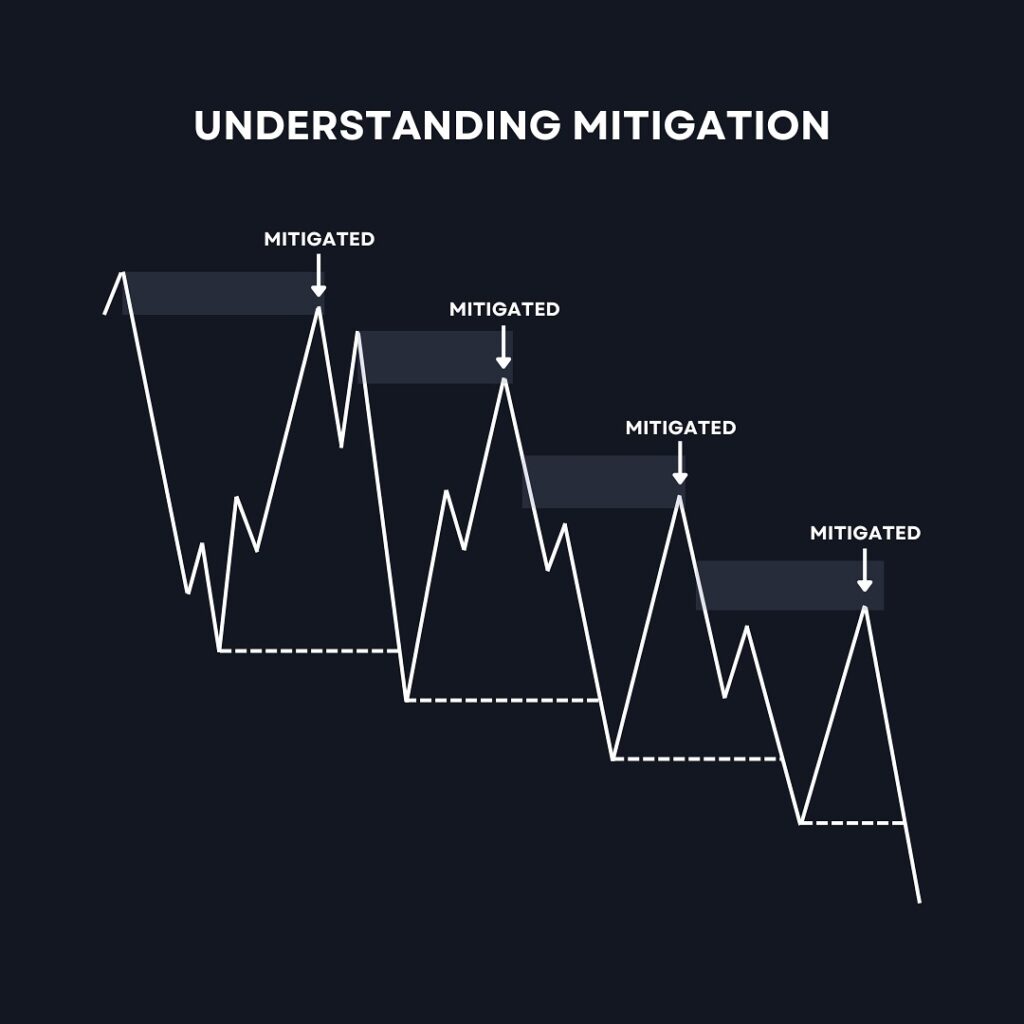

What is Mitigation?

Mitigation refers to the market revisiting or retesting previously unbalanced price levels (such as order blocks, fair value gaps, or supply/demand zones) to absorb liquidity and fulfill institutional orders. It’s a key concept in price action analysis and Smart Money trading strategies.

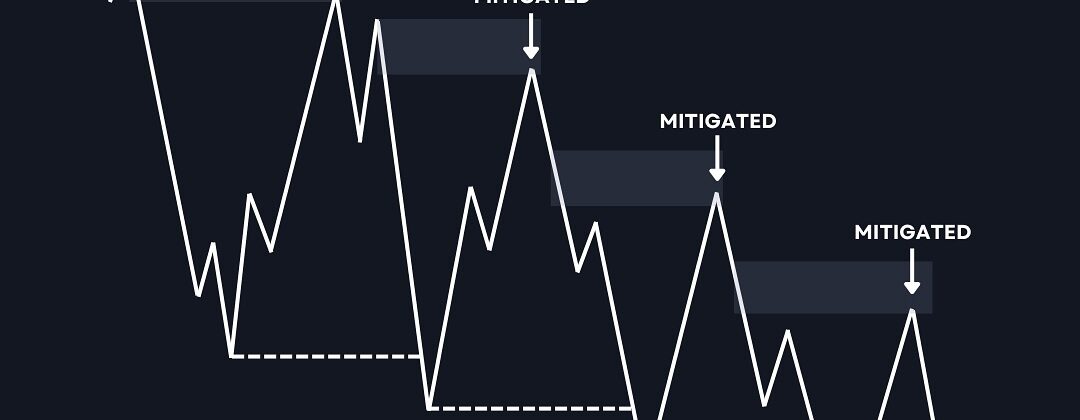

Key Observations in the Image:

- Mitigated Levels:

- Each arrow points to a zone where price retraces to mitigate an order block or imbalance.

- After mitigation, the price resumes its trend (likely a downtrend here).

- Trend Structure:

- The chart shows a series of lower highs and lower lows, signaling a bearish market.

- Mitigation zones are used as opportunities for entry in the direction of the trend.

Trade Setup Ideas:

- Identify Order Blocks:

- Look for significant price moves with untested zones, as these often become mitigation points.

- In this chart, the mitigation areas align with these untested zones.

- Wait for Price to Return:

- Allow the price to revisit a mitigation zone and look for confirmation like rejection wicks or bearish candlestick patterns.

- Enter on Confirmation:

- Upon confirmation (e.g., bearish engulfing candle), enter a short position.

- Stop loss should be above the mitigated high to protect against fake-outs.

- Take Profit:

- Aim for the next structural low or liquidity pool below the current price.

Intro for Learners:

Mitigation is a powerful concept for traders who wish to align themselves with institutional strategies. By understanding how and why the market revisits certain zones, you can better anticipate potential entries with high-risk-to-reward setups. The key is patience—waiting for price to confirm your analysis before entering a trade.

When it comes to mitigation, there are two things to consider:

1. Mitigated

2. Unmitigated

Mitigated essentially means that the POI (point of interest) you have marked up, has already been tapped into.

Whereas unmitigated just means that your POI has not yet been tapped into / price hasn’t yet reached that level.

It is better to trade from fresh / unmitigated zones.

Leave A Comment