Ignoring HTF Analysis

- Home

- Ignoring HTF Analysis

Ignoring Higher Time Frame (HTF) Analysis in Trading

Introduction

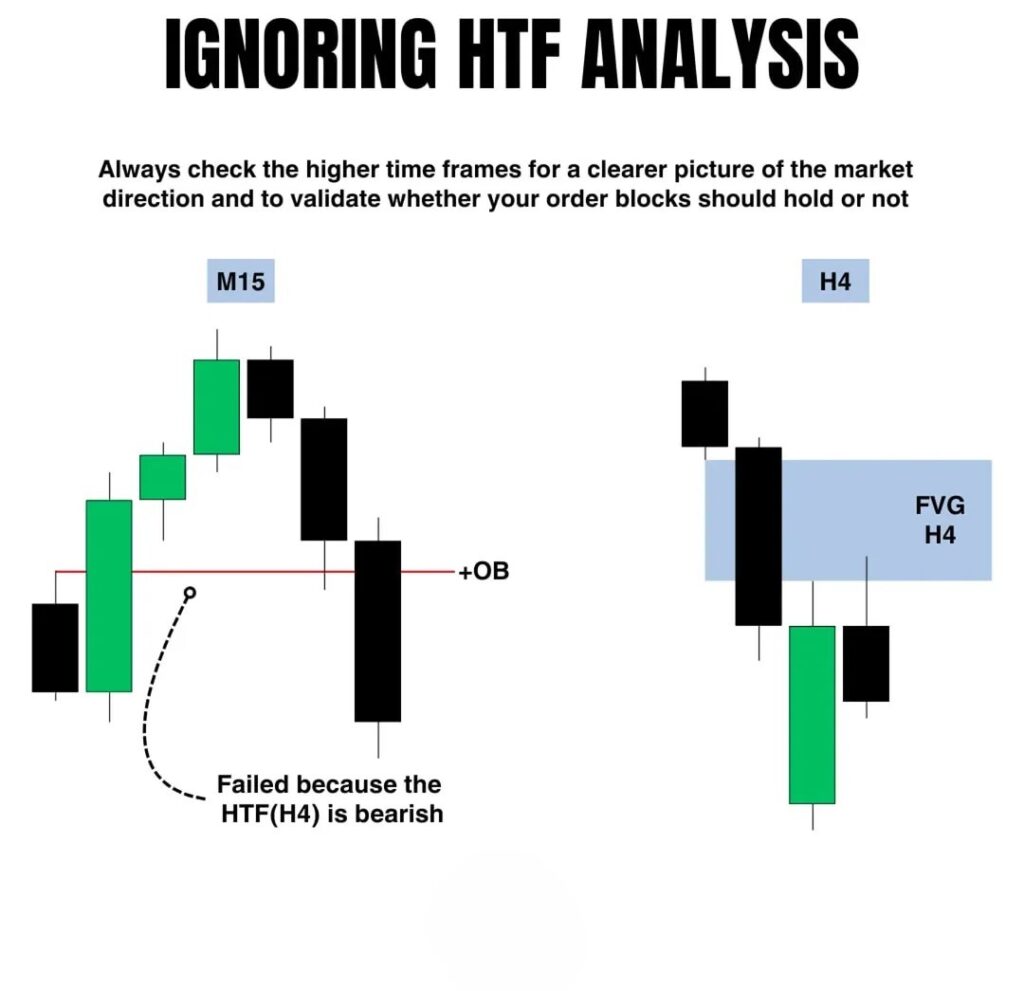

One of the most common mistakes traders make is ignoring higher time frame (HTF) analysis. Lower time frames (LTF), such as the 15-minute (M15) chart, can show bullish or bearish setups that may appear valid. However, these setups often fail if they go against the overall market structure on a higher time frame, such as the 4-hour (H4) chart.

By incorporating HTF analysis, traders can avoid taking counter-trend trades and increase their probability of success by aligning with the dominant trend.

Trade Setup Explanation (Based on Image)

- Left Side: M15 Time Frame Setup

- A bullish order block (+OB) is identified on the M15 chart.

- Price reacts to this order block, but the bullish move fails.

- The failure occurs because the HTF (H4) structure is bearish, meaning the overall market trend is down.

- Right Side: H4 Time Frame Overview

- The H4 chart shows a Fair Value Gap (FVG), indicating an area where price is likely to react.

- The market is in a bearish trend on H4, meaning bullish setups on M15 have a lower probability of succeeding.

- The price reaches the H4 FVG zone, reacts, and continues downward, reinforcing the bearish structure.

Trade Setup Idea Based on HTF Analysis

Step 1: Identify HTF Trend (H4 or Daily Chart)

- Look for clear higher highs & higher lows (bullish) or lower highs & lower lows (bearish) to determine the market direction.

- If the HTF is bearish, prioritize sell setups.

- If the HTF is bullish, prioritize buy setups.

Step 2: Confirm Trade Setup on LTF (M15 or M5 Chart)

- Look for retracements into key zones such as Order Blocks (OBs), Fair Value Gaps (FVGs), or Supply & Demand areas.

- Ensure the setup aligns with the HTF trend to improve probability.

Step 3: Enter Trade with Confirmation

- Use candlestick patterns, liquidity sweeps, or market structure shifts on LTF for entry.

- Set stop-loss above/below the invalidation zone to manage risk.

- Aim for HTF target zones (e.g., next OB, previous lows/highs, or FVGs).

Key Takeaways

✅ Always check HTF structure before taking a trade.

✅ Avoid counter-trend trades unless there is strong confirmation.

✅ Use HTF key levels to refine your LTF trade entries.

✅ Combining HTF and LTF analysis improves trade accuracy and risk management.

Leave A Comment