Bullish Mitigation Block

- Home

- Bullish Mitigation Block

Introduction to Bullish Mitigation Block

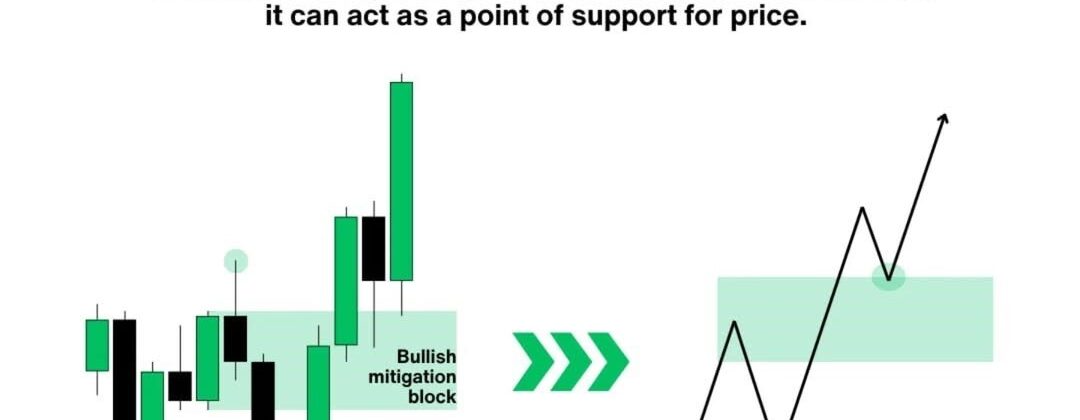

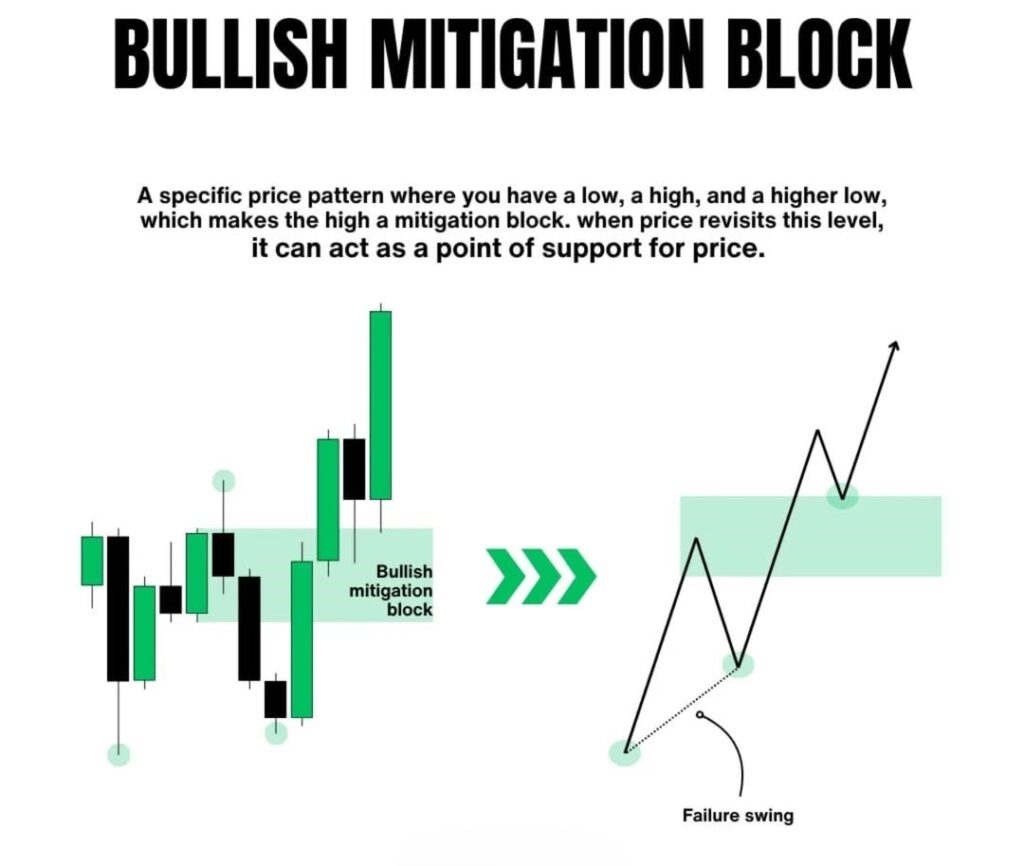

A Bullish Mitigation Block forms when price action creates a low, a high, and then a higher low. The area around the high between the low and the higher low becomes the mitigation block, a zone of interest where price may revisit later and act as support for further bullish momentum.

This structure highlights the concept of market inefficiency being filled and institutional traders (smart money) mitigating their previous orders. Traders often use this block as a point for entering buy trades, expecting price to react positively when revisiting this zone.

Key Characteristics

- Formation:

- A visible swing low, followed by a swing high, and then a higher low in price.

- The high point within this structure is the mitigation block.

- Function:

- Serves as a support zone where price is likely to react after revisiting.

- Indicates order block mitigation, where institutions balance their positions.

- Failure Swing:

- If price retraces to this zone and reacts with a bullish move, it validates the block as a strong support area.

Trade Setup Idea

- Identify the Pattern:

- Look for a clear low, high, higher low formation on a time frame of your preference.

- Mark the zone of the high as your mitigation block.

- Wait for Price Retest:

- Allow price to retrace and revisit the mitigation block zone.

- Look for additional confluences such as:

- Bullish candlestick patterns (e.g., engulfing, pin bar).

- Indicators like RSI showing oversold conditions near the block.

- Volume increase confirming the reaction.

- Enter the Trade:

- Place a buy order at or slightly above the mitigation block.

- Use a stop-loss slightly below the higher low for risk management.

- Take Profit Levels:

- Target previous swing highs or key resistance levels for partial or full take-profit.

Tips for Trading the Bullish Mitigation Block

- Confluences: Always combine this concept with other technical tools like trendlines, Fibonacci levels, or moving averages for higher probability setups.

- Time Frames: Works well across multiple time frames but is particularly effective in higher time frames (e.g., H4 or Daily).

- Risk Management: Ensure proper stop-loss placement below the higher low or the mitigation block zone to minimize losses if the setup fails.

One Reply to “Bullish Mitigation Block”

Umar Shehu

January 12, 2025Thank