Understanding Price Shifting Order Flow – 3 Key Methods

- Home

- Understanding Price Shifting Order Flow – 3 Key Methods

Understanding Price Shifting Order Flow – 3 Key Methods

Introduction

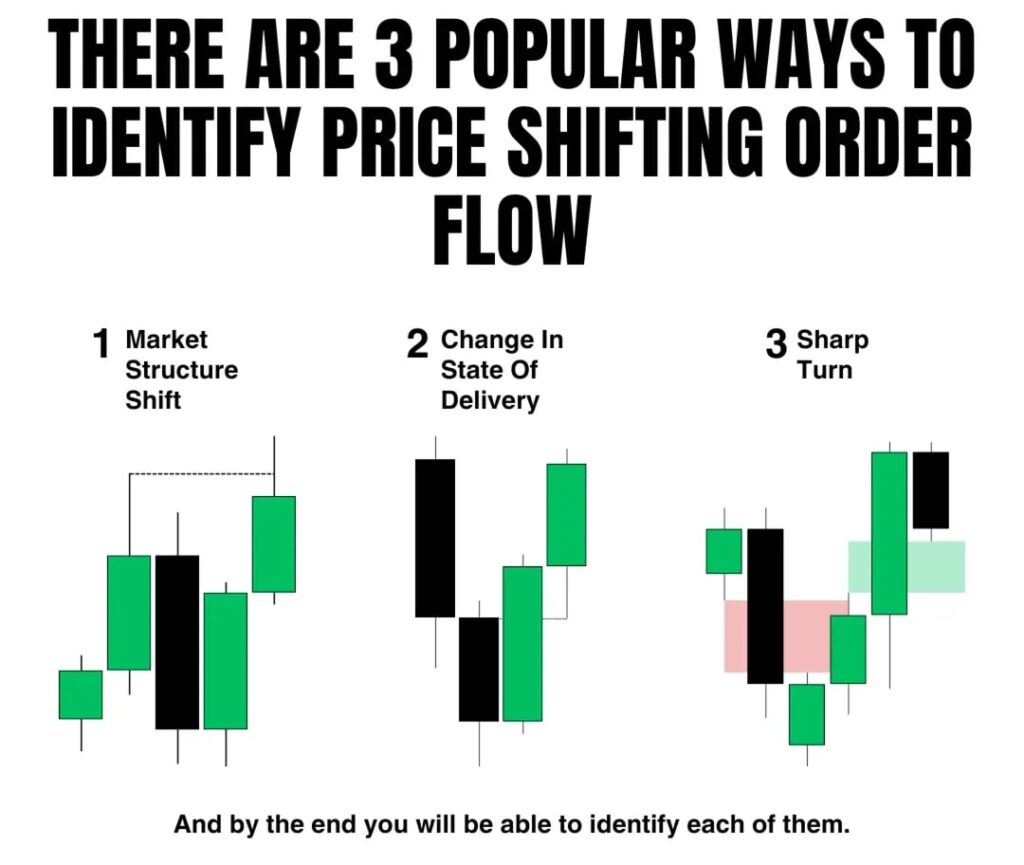

One of the most critical aspects of trading is identifying when price action shifts direction, signaling a potential trade opportunity. The image above highlights three popular methods used to detect such shifts in order flow:

1️⃣ Market Structure Shift (MSS)

2️⃣ Change in State of Delivery (CSD)

3️⃣ Sharp Turn (ST)

Recognizing these shifts early helps traders anticipate reversals, catch strong moves, and align with institutional flow for high-probability setups.

Explaining the 3 Methods in the Image

1️⃣ Market Structure Shift (MSS)

- What it is: A break in the previous trend structure, where price forms a higher high (HH) or lower low (LL) compared to past swings.

- How it works:

- In a downtrend, price fails to make a new low and instead breaks a previous high → bullish shift.

- In an uptrend, price fails to make a new high and instead breaks a previous low → bearish shift.

- Trade Idea:

✅ Look for confirmation of trend change by waiting for a pullback to a demand/supply zone before entering.

2️⃣ Change in State of Delivery (CSD)

- What it is: A shift in how price is being delivered, often seen as a sudden increase in momentum and aggressive candles in the opposite direction.

- How it works:

- Market shifts from slow, choppy movements to fast impulsive moves, signaling potential order flow change.

- Trade Idea:

✅ Enter on pullbacks after the first impulsive move, confirming the direction shift.

3️⃣ Sharp Turn (ST)

- What it is: A fast and aggressive reversal where price completely rejects a level and moves in the opposite direction with strong momentum.

- How it works:

- Price taps into a key area, sharply reverses, and engulfs previous candles, often forming liquidity grabs or stop hunts before reversing.

- Trade Idea:

✅ Look for liquidity sweeps where price spikes into an order block, grabs stop losses, and then reverses.

Trading Strategy Using These Concepts

🔹 Step 1: Identify one of the three shifts in order flow.

🔹 Step 2: Wait for a confirmation candle or a retest of the shift area.

🔹 Step 3: Enter the trade with a stop loss below (for longs) or above (for shorts) the shift zone.

🔹 Step 4: Target next major liquidity zones or key supply/demand areas.

Conclusion

Mastering these three price shift patterns will help you anticipate reversals, refine entries, and improve risk-to-reward ratios. Whether using MSS, CSD, or ST, combining them with liquidity concepts and institutional order flow will increase trade accuracy and confidence.

Leave A Comment