Internal Liquidity

- Home

- Internal Liquidity

Internal Liquidity: Understanding & Trade Setup

Introduction

Internal liquidity refers to areas within a market structure where stop losses and liquidity pools accumulate due to consecutive price movements. These areas serve as points where traders’ positions get trapped, leading to potential liquidity grabs and price reversals. Understanding internal liquidity helps traders anticipate where price may move to take out liquidity before continuing in its intended direction.

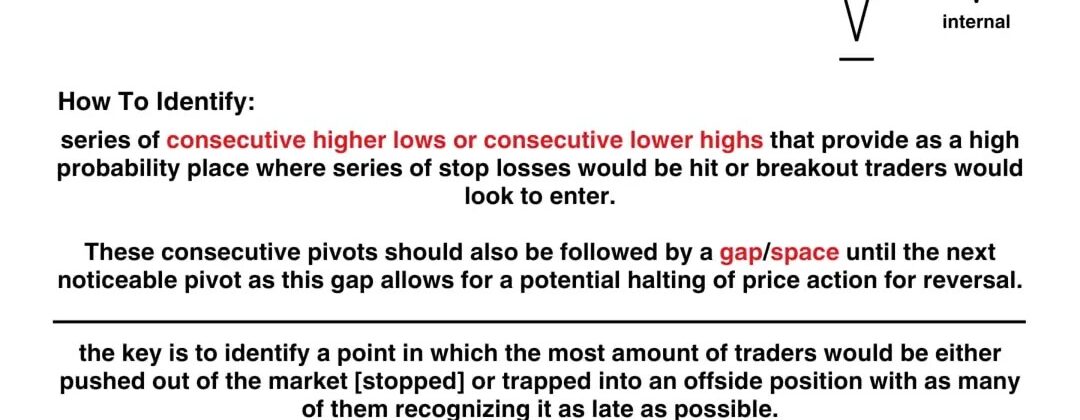

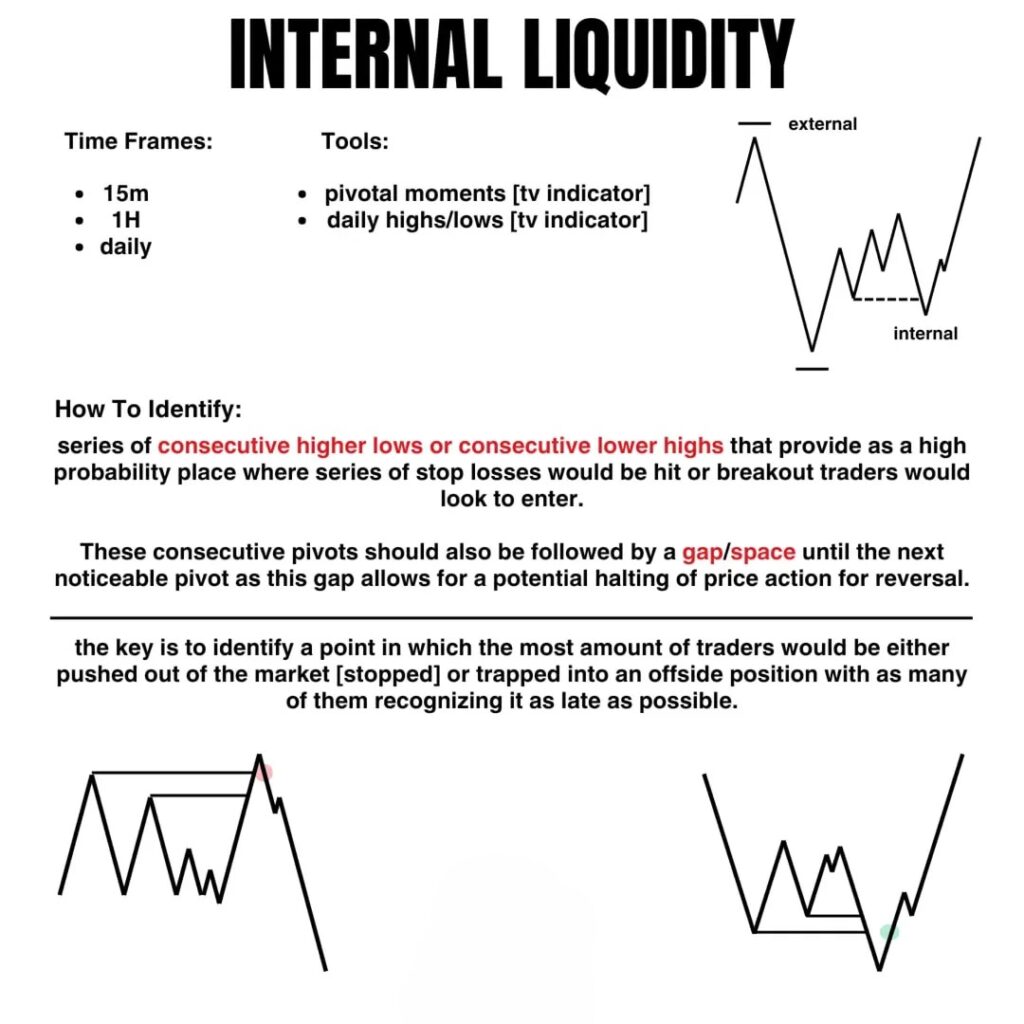

How to Identify Internal Liquidity

- Consecutive Higher Lows or Lower Highs:

- Look for a series of higher lows or lower highs in the price action. These points attract stop losses from traders following trends.

- Market makers and institutional traders often target these levels to induce liquidity before making the next move.

- Gap/Space Formation:

- The price should leave a noticeable gap between liquidity pools.

- This gap represents an inefficiency that institutions may revisit before reversing.

- Trap Traders & Induce Stop Hunts:

- The goal is to identify a zone where the market is likely to trap retail traders and force stop hunts before reversing.

- This often occurs around key support and resistance zones.

Trade Setup Using Internal Liquidity

1. Liquidity Grab & Reversal Trade

- Identify: A series of higher lows (for buy setups) or lower highs (for sell setups) forming internal liquidity.

- Wait for Stop Hunt: Look for price to sweep these levels, grabbing liquidity.

- Confirm Reversal: Enter when price shows rejection via a strong wick, bullish/bearish engulfing candle, or order block confirmation.

- Entry: Enter the trade after confirmation.

- Stop Loss: Below/above the liquidity sweep.

- Target: The next key liquidity level (external liquidity).

2. Breakout & Retest Trade

- Identify: An internal liquidity zone forming multiple higher lows or lower highs.

- Breakout: Wait for price to aggressively break the liquidity zone.

- Retest: If price retraces and retests the previous liquidity zone, it confirms the breakout.

- Entry: Enter on rejection from the retest zone.

- Stop Loss: Below/above the retest level.

- Target: The next major liquidity pool.

Final Thoughts

Understanding internal liquidity allows traders to anticipate market movements and avoid getting trapped. Combining liquidity analysis with price action, structure, and confirmation signals improves the probability of successful trades. Always consider risk management and confluence with other technical factors when trading liquidity setups.

Leave A Comment